Introduction

Picking the right health insurance is one of the most essential financial and personal choices you can make. Health insurance is not just about paying for medical bills; it’s also about giving you peace of mind when things are unclear. Because of rising healthcare expenditures, illnesses related to lifestyle, and unexpected crises, insurance coverage is now a must-have instead of a nice-to-have. The finest health insurance policy makes sure that people and families can get good medical treatment without having to worry about money.

Policies in today’s complicated insurance market have very different levels of coverage, costs, benefits, and exclusions. To make a good choice, you need to know what these distinctions are. The greatest health insurance plan should be affordable and cover a lot of things, so that policyholders don’t have to pay a lot of money out of pocket for treatment. This article goes into great detail about every important part of health insurance, helping readers learn how to compare policies and get coverage that really suits their needs.

Getting to Know the Idea of Health Insurance

Health insurance is a deal between a person and an insurance company. According to this arrangement, the insurer will pay for some or all of the insured’s medical bills, as long as the policy terms allow it. The finest health insurance plans pay for hospital stays, diagnostic testing, operations, prescriptions, and occasionally even preventive care.

The idea of insurance is to aggregate risks. A lot of people pay premiums into a shared pool, which is then used to pay for medical care for others who need it. This group method makes it less expensive for each person. The finest health insurance plans find the right balance by giving you enough coverage without charging you too much.

People can better understand why premiums differ based on age, health, and kind of coverage when they know this basic idea. It also shows why picking the appropriate policy early on can give you better coverage and save you money over time.

Why Health Insurance Is Important in Today’s World

Healthcare nowadays is quite advanced, yet it costs a lot. Even normal procedures can have a big effect on how much money you save. The finest health insurance protects people from big medical bills that can come up out of the blue. One hospitalization without insurance might ruin years of planning for your finances.

Health insurance not only protects your finances, but it also motivates you to get medical care on time. People who have insurance are more likely to get exams and treatment early, which can stop little problems from getting worse. The greatest health insurance plans generally contain wellness benefits, which means that people are more likely to take care of their health than to wait until something goes wrong.

Health insurance also gives you access to superior doctors and hospitals. People who have insurance frequently get care faster and have more options for hospitals. This access might be very important in an emergency when time and care quality are both very important.

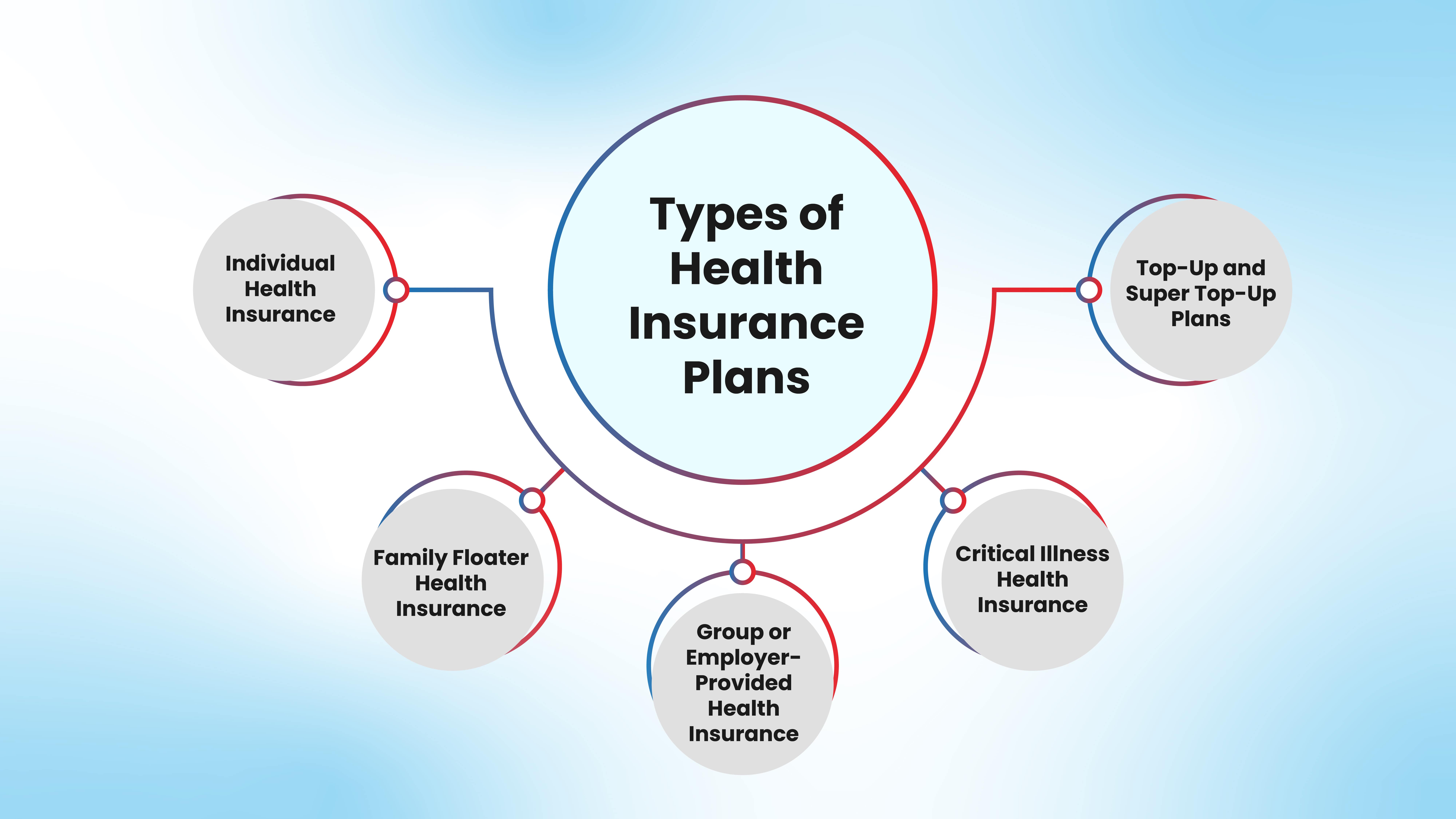

Different Kinds of Health Insurance Plans are Available

There are many distinct types of health insurance policies, each made to satisfy a different need. Individual health insurance just covers one person and is a good choice for people who don’t get benefits from their jobs. Family floater plans protect more than one family member under one policy, and they usually cost less when you combine them.

Employers usually offer group health insurance, which covers employees and sometimes their families. These plans are easy to use, but they may not necessarily offer the best health insurance coverage when it comes to personalization. Plans for seniors address on the needs of older adults, including as covering illnesses that are more common in older adults and higher medical risks.

People may evaluate several sorts of plans and find the one that works best for their lifestyle, family size, and financial goals by knowing what they are.

What Makes the Best Health Insurance Stand Out

There are some things that all good health insurance plans have in common. One of the most crucial things is full coverage. This includes costs for hospitalization, care before and after treatment, and sometimes care outside of the hospital. A large network of hospitals makes it possible to get treatment without paying up front.

Another important thing is that there is an acceptable waiting period for pre-existing conditions. Shorter waiting times make a policy more valuable, especially for people who already have health problems. The greatest health insurance also lets policyholders change their coverage as their needs change by giving them a range of sum insured options.

It’s also vital for policy words to be clear. When making a claim, clear definitions of what is included and what is not might assist avoid arguments. Policies that make it easy to file a claim and have customer service that is quick to respond usually give you a better overall experience.

Things to Think about When it comes to Costs and Premiums

The price of health insurance varies based on a number of things, such as your age, medical history, lifestyle, and the amount of coverage you need. Younger people usually pay less in premiums, so signing up early is a good idea. The finest health insurance offers good coverage at a price you can afford.

more coverage limits mean more premiums, but they also mean more financial protection. Deductibles and co-payment clauses can lower rates, but they can also make claims more expensive for you. To make the best choice, you need to understand these trade-offs.

You should think about how affordable premiums will be in the long run. A insurance that looks cheap at first may end up costing a lot if it doesn’t offer many advantages or has a lot of exclusions. The finest health insurance gives you the same amount of coverage for the whole policy period.

The Role of Network Hospitals and Cashless Care

Network hospitals are a big part of what makes a health insurance coverage easy to use. Cashless treatment lets people with insurance get medical care without having to pay for it up front. The insurance company pays the hospital immediately for the care.

The greatest health insurance plans offer large networks of hospitals, which means you can get good care in a lot of different places. This is really significant for people who travel a lot or reside in places where there aren’t many healthcare facilities.

A strong network of hospitals is also a sign of the insurance company’s trustworthiness and quality of service. If you want to get treatment outside of the network, policies with limited networks may limit your options and cost you more.

Why the Claim Settlement Ratio Matters

The claim settlement ratio shows how many claims an insurance company resolves compared to how many it gets. A greater percentage means that the business is reliable and customers trust it. It is a crucial sign to look at while choosing the best health insurance, but it is not the only one.

When there is a medical emergency, fast claim settlement processes make things less stressful. Policies that don’t need a lot of paperwork and handle claims quickly are preferable when you need them most. The greatest health insurance companies spend money on technology and customer service to make claims easier.

Knowing this part helps policyholders stay away from insurers with bad records and makes things go more smoothly during important periods.

Table 1: A comparison of different types of health insurance plans

| Plan Type | Coverage Scope | Suitable For | Key Advantage |

|---|---|---|---|

| Individual Plan | Single person coverage | Working professionals | Personalized coverage |

| Family Floater | Entire family under one sum insured | Families | Cost-effective |

| Group Insurance | Employees and dependents | Salaried individuals | Employer-supported |

| Senior Citizen Plan | Age-related illnesses | Elderly individuals | Specialized coverage |

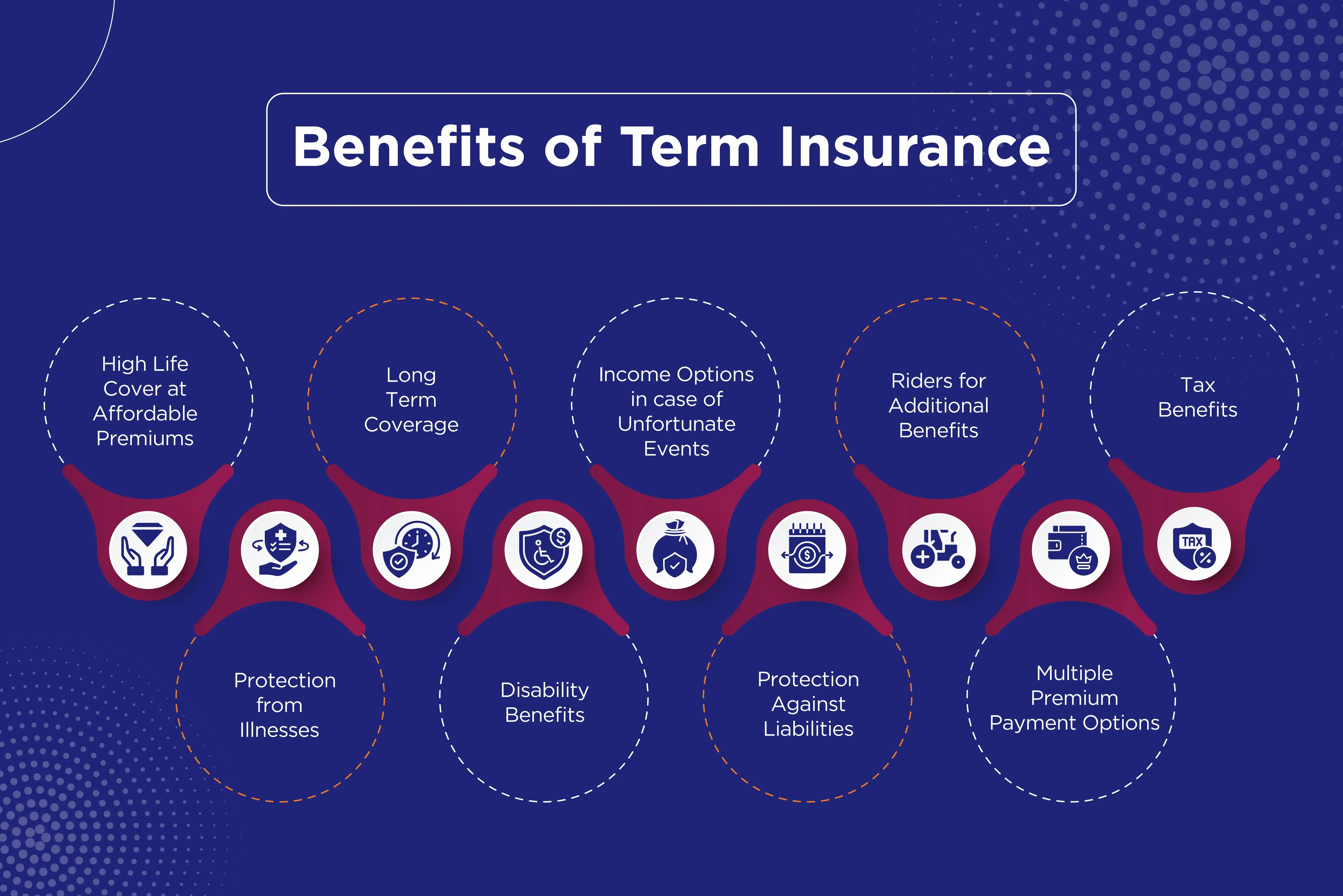

Add-On Covers and Riders

Add-on covers make a base health insurance policy cover more things. These optional advantages let you choose what works best for you. Critical illness cover, maternity benefits, and a waiver of hotel rent are all common riders.

The best health insurance plans let you add extras that provide you more coverage without boosting your payments too much. For instance, a critical illness rider pays you a lump sum when you are diagnosed, which might help you pay for treatment and living costs.

To choose the right riders, you need to carefully think about your health risks and plans for the future. further features that aren’t needed can raise expenditures without giving you any further benefits.

Benefits of Preventive Care and Wellness

Modern health insurance puts more and more emphasis on preventive care. A lot of insurance now cover health checks, immunizations, and wellness programs. These benefits motivate people to live healthy lives and find problems early.

The greatest health insurance includes preventative treatment in its coverage, which lowers long-term healthcare expenses for both the insurer and the policyholder. Regular exams help find problems early, which means treatments are less intense and cost less.

Discounts on fitness classes or prizes for good habits are other wellness advantages that may be available. These kinds of features add value beyond basic coverage and help people feel better overall.

Table 2: Things That are Usually Included and Things That are Not

| Aspect | Typically Included | Commonly Excluded |

|---|---|---|

| Hospitalization | Yes | Cosmetic procedures |

| Pre-existing Diseases | After waiting period | During initial years |

| Daycare Procedures | Yes | Experimental treatments |

| Preventive Checkups | Limited | Lifestyle surgeries |

How to Pick the Right Health Insurance for You

To choose the finest health insurance, you need to follow a methodical process. Start by looking at your and your family’s medical needs, including any current conditions and any dangers that may come up in the future. The amount of coverage should be in line with the cost of healthcare in your area.

When you compare several insurance, you may see how their benefits, exclusions, and pricing are different. Reading policy documents attentively makes sure you understand the terms and conditions. The greatest health insurance policy is one that fulfills your needs without being too complicated.

Long-term factors are just as significant. Policies that let you easily upgrade, move, and renew without age limits provide you more options. Taking the time to think about these things can help you make better choices.

Things You Shouldn’t Do When Buying Health Insurance

One mistake that many people make is only looking at the cost of the premium. Cost is important, but not having enough coverage might lead to higher costs in the future. The finest health insurance puts value ahead of price.

Another mistake is not paying attention to the policy’s exclusions and waiting periods. These details have a big effect on coverage in the first few years. Not telling the insurance company about your medical history can potentially cause them to deny your claim.

Don’t pick a policy unless you know how to file a claim. When things go wrong, a difficult or sluggish process can make things worse. Knowing about these problems helps people make smart decisions.

Health Insurance Has Long-term Benefits

Health insurance offers benefits that go beyond just paying for medical care right now. It protects savings, helps with financial planning, and makes sure that care continues. Over time, the finest health insurance helps keep your finances stable.

Policyholders also get cumulative bonuses for years without claims, which provide them more coverage without costing them more. This feature encourages people to be healthy and stick with it for a long time.

Having insurance also means you don’t have to rely on loans or selling your assets when you have a medical emergency. This consistency is very important for keeping a good quality of life and reaching future goals.

Health Insurance in the Future

As technology and data analytics improve, the health insurance market is changing. Digital platforms make it easier to handle policies, claims, and customer service. Telemedicine and remote consultations are now standard features of coverage.

The greatest health insurance companies are adapting to these changes by coming up with new ways to make things easier and more accessible. Plans that are tailored to each person based on data-driven insights are going to be more common.

Insurance will become even more important as healthcare demands change to make sure that everyone can get good treatment at a price they can afford.

In conclusion

Picking the right health insurance is an important step toward both financial security and personal wellness. A good policy protects you from growing medical costs, makes sure you can get good medical treatment, and gives you peace of mind when things are unclear. People can make smart choices when they know about the many types of plans, what they cover, how much they cost, and what the long-term advantages are.

Low premiums and wide coverage don’t always mean the greatest health insurance. The best health insurance is the one that fits your needs and stage of life the best. Insurance will always be there for you if you carefully evaluate it, buy it on time, and review your policy regularly. By making educated choices a priority, people may be sure of their health and financial future.

Read More:- How Much Is Health Insurance? Costs, Factors, and Coverage Guide