Introduction: Understanding Health Insurance Costs

Health insurance has become one of the most important financial and personal decisions people make in their adult lives. Whether you are self-employed, working for a company, supporting a family, or planning for retirement, the question that often comes first is how much is health insurance and what exactly are you paying for. The answer is not simple because health insurance costs vary widely depending on personal, economic, and policy-based factors. Many people assume there is a single average price, but in reality, health insurance pricing is shaped by age, location, coverage level, provider network, and overall health risk.

Health insurance is not just a monthly bill. It is a system designed to reduce financial risk during illness, accidents, or long-term medical needs. Understanding costs requires looking beyond premiums and considering deductibles, co-payments, and out-of-pocket limits. When people ask how much is health insurance, they are often trying to balance affordability with protection, making sure they are not underinsured or paying more than necessary.

This article explains health insurance pricing in depth, helping readers understand average costs, influencing factors, coverage types, and cost management strategies. By the end, you will have a clear picture of how health insurance pricing works and how to evaluate whether a plan is worth its cost.

What Health Insurance Really Covers

Health insurance is designed to cover a broad range of medical services, but coverage varies by plan. Most standard policies include hospital stays, doctor visits, emergency care, prescription medications, and preventive services. Some plans also include mental health support, maternity care, rehabilitation, and chronic disease management. The level of coverage plays a major role in determining how much is health insurance for any individual or family.

Plans with broader coverage typically have higher premiums because the insurer takes on more financial risk. In contrast, limited coverage plans often come with lower monthly costs but may require higher out-of-pocket spending when care is needed. Understanding what a policy covers is essential before comparing prices, as a cheaper plan may not offer sufficient protection in real-life medical situations.

Coverage also includes network access. Plans with wider provider networks allow patients to choose from more hospitals and specialists, which usually increases cost. Narrow network plans are often cheaper but restrict provider options. When evaluating health insurance prices, coverage quality should always be considered alongside cost.

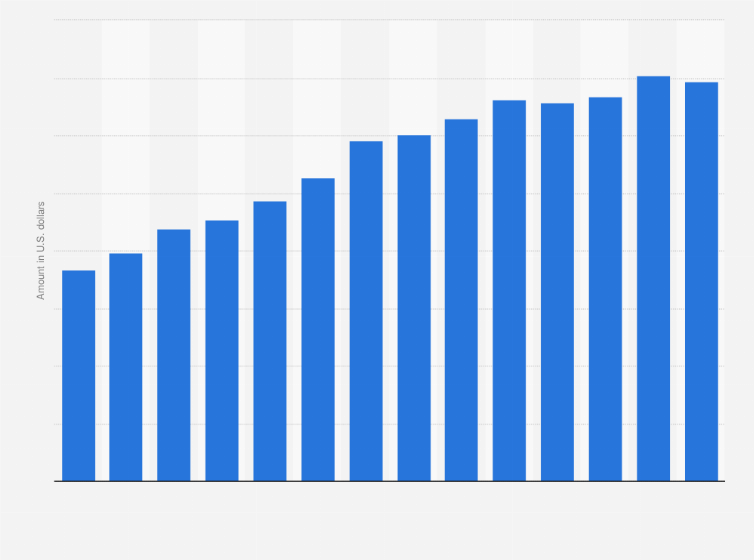

Average Health Insurance Costs Explained

When people ask how much is health insurance, they often expect a single number. In reality, average costs differ based on whether coverage is individual, family-based, or employer-sponsored. Individual health insurance premiums are typically lower than family plans, but they still vary significantly by age and region.

Employer-sponsored health insurance is usually more affordable because companies share the cost with employees. Self-employed individuals or freelancers often pay higher premiums because they do not benefit from group pricing. Government-supported or subsidized plans can reduce costs for eligible individuals, but availability and pricing depend on income levels and policy rules.

It is also important to understand that premiums are only part of the total cost. A plan with a low monthly premium may have a high deductible, meaning you pay more before insurance begins covering expenses. Average cost discussions should always include both monthly and annual spending expectations.

Factors That Affect Health Insurance Pricing

Health insurance pricing is influenced by a combination of personal and systemic factors. Age is one of the most significant contributors. Older individuals generally pay higher premiums because they are more likely to require medical care. Location also matters, as healthcare costs vary by region due to hospital pricing, provider availability, and local regulations.

Health status can influence pricing in some systems, especially in private insurance markets. Lifestyle factors such as smoking may also increase premiums. Plan design plays a major role as well. High-deductible plans cost less monthly but shift more financial responsibility to the insured. Comprehensive plans cost more but offer lower out-of-pocket expenses.

Understanding these factors helps clarify why two people may receive very different answers to the question of how much is health insurance, even if they live in the same city.

Types of Health Insurance Plans and Their Costs

Health insurance plans come in several structural types, each with different cost implications. Some plans emphasize flexibility in choosing providers, while others focus on cost control through limited networks. Plans with referral requirements often cost less but restrict access to specialists.

Managed care plans are typically more affordable because they coordinate care through primary physicians. Fee-for-service models provide more freedom but come at a higher price. Catastrophic plans are designed for emergencies and have very low premiums but extremely high deductibles, making them unsuitable for people who need regular care.

Each plan type represents a trade-off between monthly affordability and access to care. Evaluating these trade-offs is essential when deciding which plan offers the best value for your specific needs.

Monthly Premiums Versus Total Annual Costs

Many people focus only on monthly premiums when asking how much is health insurance, but this approach can be misleading. A lower premium does not always mean a cheaper plan overall. Deductibles, co-payments, and coinsurance can significantly increase total annual costs.

For example, a plan with a low premium but high deductible may cost less if you rarely use medical services. However, if you need frequent care, that same plan could become more expensive than a higher-premium plan with lower out-of-pocket expenses. Evaluating total annual cost helps ensure financial predictability and reduces the risk of unexpected medical bills.

Out-of-pocket maximums also matter. Once you reach this limit, the insurer covers most remaining costs. Plans with lower out-of-pocket maximums usually have higher premiums but offer greater financial protection during serious illness.

Table 1: Average Monthly Health Insurance Costs by Coverage Type

| Coverage Type | Average Monthly Cost (Individual) | Average Monthly Cost (Family) |

|---|---|---|

| Basic Coverage Plan | Moderate | Higher |

| Standard Comprehensive Plan | Higher | Significantly Higher |

| High Deductible Plan | Lower | Moderate |

| Employer-Sponsored Plan | Lower | Moderate |

| Self-Employed Private Plan | Higher | Very High |

Employer-Sponsored Health Insurance Costs

Employer-sponsored health insurance remains one of the most affordable options for many people. Employers typically pay a large portion of the premium, reducing the employee’s monthly contribution. This shared cost structure explains why people with employer coverage often pay less than those purchasing individual plans.

However, employees still need to evaluate deductibles and network limitations. Employer plans may restrict provider choices or require higher co-payments. Despite these limitations, employer-sponsored insurance often offers strong value, making it a popular choice for working professionals and families.

When evaluating how much is health insurance through an employer, it is important to review benefit summaries carefully. Some plans appear inexpensive but offer limited coverage, while others justify higher premiums through better benefits and lower out-of-pocket costs.

Health Insurance for Families and Dependents

Family health insurance plans cost more than individual coverage because they insure multiple people under one policy. The cost increases with the number of dependents, but family plans often offer better overall value than purchasing separate individual policies.

Family plans usually include pediatric care, maternity services, and preventive screenings. These benefits can reduce long-term healthcare costs by promoting early diagnosis and treatment. While monthly premiums may seem high, family coverage often lowers per-person costs compared to individual plans.

Families should carefully consider coverage limits, network size, and cost-sharing requirements. Understanding these elements provides a clearer picture of how much is health insurance for households with diverse medical needs.

Health Insurance for Self-Employed Individuals

Self-employed individuals face unique challenges when purchasing health insurance. Without employer contributions, they are responsible for the full premium cost. This often results in higher monthly expenses compared to those with employer coverage.

However, self-employed individuals have more flexibility in choosing plans that match their specific needs. Some may opt for high-deductible plans paired with savings strategies, while others prioritize comprehensive coverage to reduce financial risk.

Cost management becomes especially important in this group. Evaluating annual costs, tax considerations, and long-term healthcare needs helps self-employed individuals answer the question of how much is health insurance in a realistic and sustainable way.

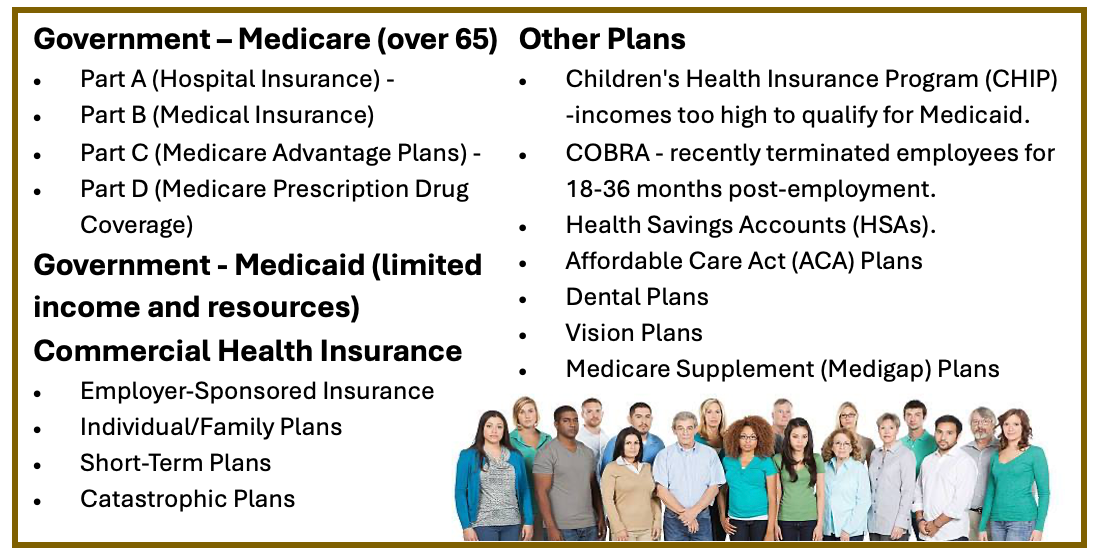

Government-Supported Health Insurance Programs

Government-supported health insurance programs are designed to make healthcare accessible for lower-income individuals, seniors, and specific populations. These programs often reduce premiums and out-of-pocket expenses based on eligibility criteria.

While government programs can significantly lower costs, coverage options may be limited. Provider availability, waiting times, and service restrictions vary by program. Understanding eligibility requirements and coverage details is essential before relying on government insurance as a primary healthcare solution.

For many people, government programs provide an affordable answer to how much is health insurance when private coverage would otherwise be financially out of reach.

Table 2: Cost Comparison Based on Deductible Levels

| Deductible Level | Monthly Premium Cost | Out-of-Pocket Risk |

|---|---|---|

| Low Deductible | High | Low |

| Medium Deductible | Moderate | Moderate |

| High Deductible | Low | High |

How Lifestyle and Health Influence Costs

Lifestyle choices and overall health can affect insurance pricing and long-term expenses. Individuals with chronic conditions often require plans with better coverage, which may increase premiums. Preventive care and healthy habits can reduce medical needs over time, potentially lowering overall costs.

Some insurance systems consider smoking status and health history when pricing policies. Maintaining a healthy lifestyle can help reduce both direct medical expenses and indirect insurance costs.

Understanding the relationship between health and insurance pricing allows individuals to make informed decisions that balance current affordability with future needs.

Strategies to Manage Health Insurance Costs

Managing health insurance costs requires thoughtful planning rather than simply choosing the cheapest plan. Comparing coverage levels, estimating annual medical usage, and understanding cost-sharing structures are essential steps.

Selecting a plan that matches your healthcare usage pattern can prevent unnecessary expenses. Regular users of healthcare services may benefit from higher-premium plans with lower deductibles. Those with minimal healthcare needs may save money with high-deductible options.

By focusing on value rather than just price, individuals can better understand how much is health insurance in practical, real-world terms.

Common Misconceptions About Health Insurance Pricing

One common misconception is that higher premiums always mean better coverage. While this can be true, some high-cost plans include features that may not be relevant to every individual. Another misconception is that young, healthy people do not need insurance, ignoring the financial risk of unexpected accidents or illness.

Many people also underestimate out-of-pocket costs, assuming insurance covers everything. In reality, deductibles and co-payments can significantly impact total expenses. Clearing up these misconceptions helps consumers make smarter, more cost-effective decisions.

The Future of Health Insurance Costs

Health insurance costs continue to evolve due to medical inflation, technological advancements, and policy changes. Innovations in telemedicine, preventive care, and digital health management may help control future costs. However, rising healthcare expenses and aging populations present ongoing challenges.

Staying informed about industry trends and policy updates helps individuals anticipate changes in pricing and coverage. Understanding how much is health insurance today provides a foundation for planning future healthcare expenses responsibly.

Conclusion: Making Sense of Health Insurance Costs

Health insurance pricing is complex, but understanding its structure makes it easier to navigate. The question of how much is health insurance cannot be answered with a single number, as costs depend on coverage type, personal circumstances, and healthcare needs. Monthly premiums, deductibles, and out-of-pocket limits all contribute to the true cost of coverage.

By evaluating plans carefully, considering long-term needs, and focusing on overall value rather than just price, individuals and families can make informed decisions. Health insurance is not just an expense but an investment in financial security and well-being. With the right knowledge, choosing the right plan becomes a confident and informed decision rather than a confusing one.

Read More:- How to Start a Business Successfully: A Complete Beginner Guide